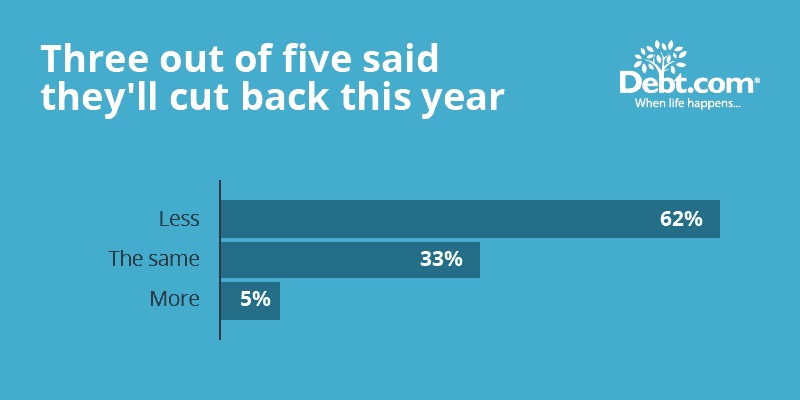

FORT LAUDERDALE, FL – November 17, 2020 – (LATINX NEWSWIRE) – When Debt.com polled more than 1,200 adults about their holiday plans, nearly two-thirds said they will spend less this year. We expected it was due to the pandemic’s effect on the economy and personal finances, but almost 60 percent said their reasons were non-economic.

Thirty-seven percent said, “I feel less pressure to buy gifts because of virtual celebrations,” while 23 percent said, “I don’t expect loved ones to spend much on me due to the pandemic.” Debt.com chairman Howard Dvorkin has a name for this: Grinch logic.

“I’ve spent nearly three decades counseling Americans on how to save more and spend less, but that’s nearly impossible to do during the holidays,” Dvorkin says.

No matter how blunt they are about their debts, they’ll blow their holiday budget. Why? Because Americans fear only one thing more than going broke. They fear their friends and family will think they’re cheapskates. Everyone wants to be Santa Claus, and no one wants to be the Grinch.

The National Retail Federation said holiday spending topped $1,000 per consumer last year. Debt.com’s survey shows most respondents expect to spend half that:

— Almost 73% will spend less than $500

— 18% said up to $1,000

— 6% said up to $1,500

— Only 2% will spend over $1,500

Nearly one-third of people polled said they would spend the same as last year. That’s a significant drop when you consider holiday spending has increased every year since 2010, according to Statista, a leading provider of market and consumer data.

Some of the spending cutbacks are travel-related:

— 18% will celebrate virtually exclusively

— 31% will celebrate in-person

— 51% will do a combination of both

Thirty percent of those polled said they will spend less due to lost income and 11 percent said they lost their job. Follow Debt.com’s smart holiday spending tips to stay out of debt this holiday season:

— Plan and budget. The recommend holiday spending amount is between .5 to 1.5 percent of annual take-home pay. So, if a person takes home $60,000 per year, they should spend no more than $900 on the holidays.

— Don’t procrastinate. Not only are people more likely to overspend if they shop last minute, but it also makes an already stressful time of the year even more so.

— Price check with your phone. If a gift is over budget, use the phone to find a better price elsewhere before buying. Many stores have price-match policies if you find a better deal.

— Use smart online shopping habits. If a person’s debit card number is stolen, the thief can take money directly from the accounts. It’s safer to use a low-interest credit card and pay it off in full.

–Use rewards before they expire. Many credit cards offer discounts and free gift cards that can be used for holiday gift-giving while saving people money.

For more tips, visit Debt.com’s saving money section.

SOURCE: Debt.com

About Debt.com

Debt.com is the consumer website where people can find help with credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com works with vetted and certified providers that give the best advice and solutions for consumers ‘when life happens’.