FORT LAUDERDALE, Fla., Feb. 23, 2023 /Noticias Newswire/ — Debt.com’s annual Divorce and Debt Survey shows a disturbing trend from 2022 to 2023: Inflation might be a contributing factor in recent divorces.

“While it’s impossible to attribute divorce specifically to inflation, economic factors are a major reason for breakups.”

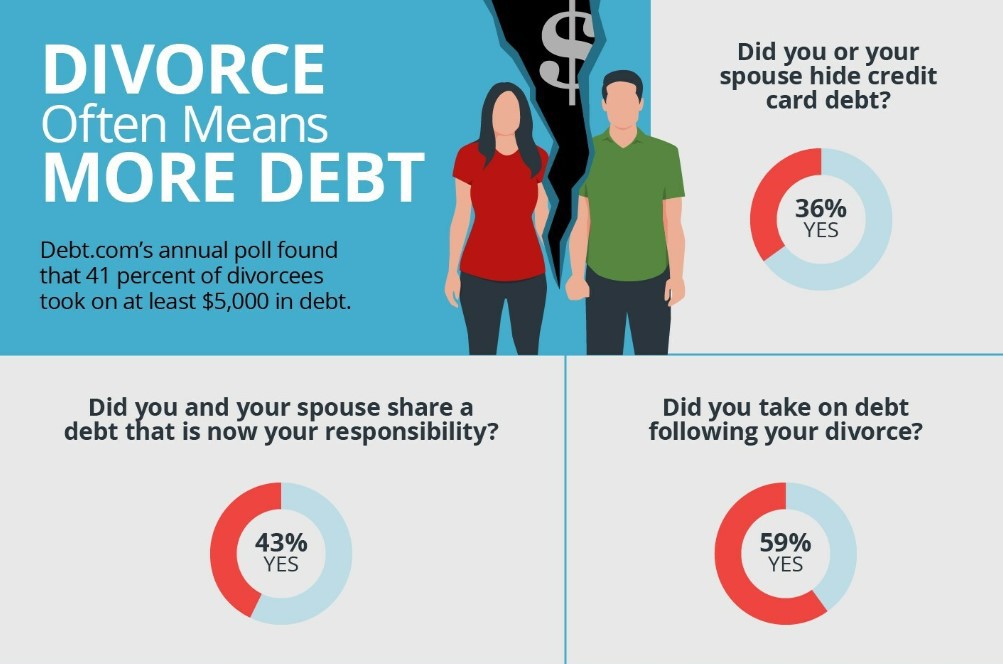

Debt.com survey finds credit card debt and spending were big factors in divorce. Nearly a third of respondents said credit card debt contributed to their divorce.

Forty-two percent said the largest contributing factor was “disagreements on big purchases” such as cars, appliances, and furniture, eclipsing credit card debt at 29 percent. Debt.com president Don Silvestri says that’s a significant statistic.

“High inflation affects all prices, but big-ticket items can pose big relationship problems,” Silvestri says. “No divorce is simple, and there’s rarely a single cause, but it’s quite apparent from these results that a sour economy has also soured some marriages.”

Silvestri says it’s concerning because “the economy isn’t going to turn around anytime soon.” Other survey results support that idea:

- Generally, “financial difficulties” were “primary factors” in divorce for 25 percent of respondents this year – up from 21 percent in 2022.

- In 2023, 40 percent of respondents took on between $1,000 and $10,000 in debt after their divorce. In 2022, it was only 33 percent.

- Debt is so intimidating that couples are trying to avoid divorce. Nearly 30 percent of divorcees said they considered separation. Last year, it was 20 percent.

“While it’s impossible to attribute divorce specifically to inflation and other economic factors, it’s clear they’re being cited more often as a pain point,” Silvestri says. “Sadly, with inflation slowing but not stopping, we expect to see more struggling couples citing economic factors as major reasons for their breakups.”

About: Debt.com is a consumer website where people can find help with credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com works with vetted and certified providers that give the best advice and solutions for consumers ‘when life happens.’

*Percentages are rounded up to the nearest whole number and might not total 100 percent.

SOURCE Debt.com